While near-term fundamentals and geopolitical risks are currently driving oil market discussions, a seismic shift occurred last year in the medium- to long-term outlook. For years, long-term forecasts assumed global oil demand would decouple from GDP and peak around 2030, driven by aggressive climate policy, rapid EV adoption, and extraordinary efficiency gains.

That world no longer exists. Low interest rates, stable geopolitics, cheap energy, and open trade have given way to inflation, conflict, tariffs, and energy-security priorities. Policy support for EVs is weakening across the United States, Canada, Europe, and China. Investors will remember 2025 as the year belief in peak oil demand itself peaked, and consensus began shifting back to the reality that oil demand is likely to continue rising for decades.

Yet even as the world adopts a more realistic outlook on oil demand growth and government policies to bend the demand curve downward, the oil industry must still grapple with the potential for electric vehicle (EV) adoption to displace road fuel demand in the coming decades.

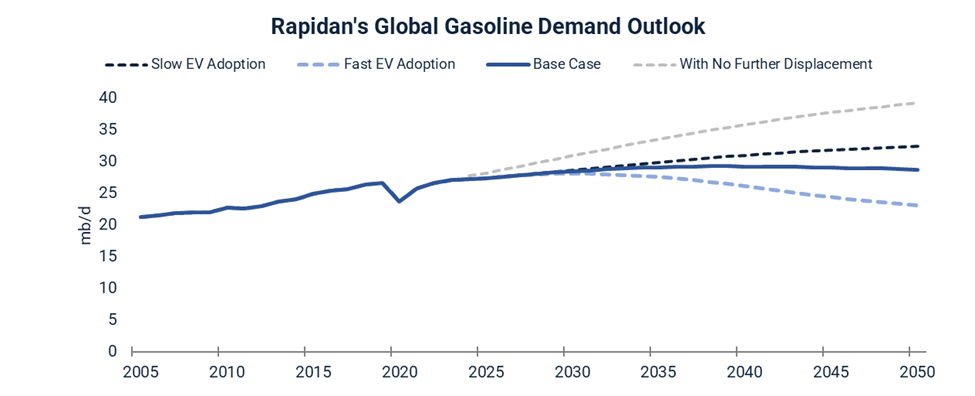

Rapidan’s long-term energy modeling never bought into the policy-driven, imminent-peak-demand view. However, we do consider more realistic – if longer-term – scenarios in which voluntary consumer-led EV adoption significantly displaces gasoline and diesel consumption.

Rapidan Energy Group's Oil Outlook indicates that by 2040, EVs could displace 3.5-7.4 mb/d of global road fuel demand from passenger vehicles (excluding two- and three-wheelers, as well as commercial vehicles such as buses), depending on technological advancements and shifts in consumer preference that drive rapid, voluntary, adoption.

The Market Consensus Is Shifting Back to Reality

Until recently, most consensus forecasts assumed that aggressive energy transition policies – especially those aimed at driving rapid, widespread EV adoption – would cause global oil demand to peak around 2030. Reality has since undermined the peak-demand consensus. OECD gasoline consumption remains resilient, EV sales growth is well below levels needed to meaningfully reduce global gasoline demand, and governments in key consumer markets – especially Washington, Brussels, and Beijing – continue to weaken remaining EV policy support.

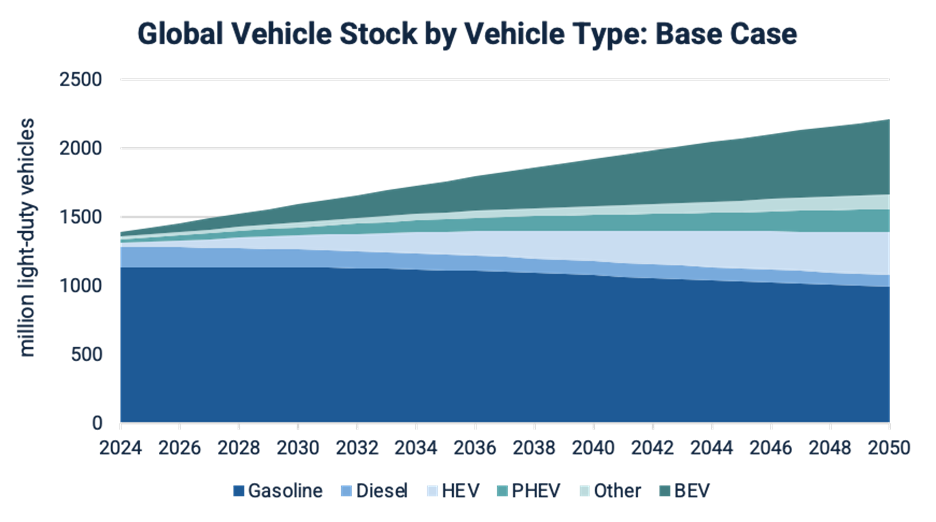

Recent data highlight several misconceptions about the effects of EV fleet penetration on road fuel demand. A common and impactful error is assuming that a surge in EV sales will lead to a corresponding rapid, sharp drop in gasoline consumption. There are many reasons why high annual EV adoption rates do not necessarily mean that demand will peak soon. These include changes in the total number of vehicles on the road, scrappage rates, fleet turnover rates, usage patterns, fuel efficiency trends, infrastructure constraints, fuel prices, and consumer behavior.

Given EVs’ very low initial share of the world’s total vehicle stock, it was clear that any near‑term peak in oil demand would require mainly continuous, outsized increases in fuel‑efficiency gains for internal combustion engine (ICE) vehicles. Instead of the typical 1%-2% ICE fleet efficiency gains, achieving peak demand would require sustained 5%-6% improvements. However, there is no evidence of significant efficiency gains within the ICE fleet. On the contrary, consumer preferences for safety and larger vehicle sizes are offsetting the gains in fuel efficiency.

A further nuance is the composition of EV sales. BEVs fully displace gasoline demand, whereas conventional hybrids primarily reduce consumption per vehicle rather than eliminate it. Plug-in hybrids occupy a middle ground, with gasoline displacement dependent on usage patterns. In general, hybrids have been more widely adopted than BEVs in most markets.

Rely on Sound Analysis Rather Than Wishful Thinking

Markets are learning an essential, but costly, lesson: EV adoption depends on consumer preferences shaped by economics, usability, and convenience. Government promises to accelerate EV adoption through subsidies and mandates do not provide a reliable basis for committing large amounts of capital. Policy still matters, but it remains constrained and unstable. Investors should base energy and transportation decisions on unbiased data and realistic assumptions about costs and consumer behavior, rather than on aspirational policy goals.